It seems easy to manage your money just by remembering or note down on the papers.

Right?

However, the reality is completely different.

Tracking each penny every time can be annoying. Here comes Budget management, which only plays an important role when you are not able to save money to secure your future. Unusual spending distracts you to achieve your financial goal.

Another reason: when digital payments take place instead of cash flow, then fraud and insecurities also have risen. The digital apps do not only enable you to track your transactions and give you a picture of your account but watch your account activity through every platform.

1. Famzoo

FamZoo’s name itself explains that it is developed for whole family members including younger and elders. Real & virtual money options are available where virtual works for IOU (“I owe you“) to track the transactions. On the other hand, the real money option provides the cards for spending. You will feel like a banker while your children are customers.

This budgeting app provides you a setup for loan payments and allows you to manage future expenses. Not only this, but it also enables you to set up a to-do list or one-off task by adding a bonus.

Here’re some features that will give you a glance at FamZoo’s app features:

- FamZoo helps you to transfer the money easily within your family member in an emergency condition.

- It enables your entire family to save money and compound interest.

- You can access and control other family members’ or children’s accounts. By using this app, you can shop or buy anything from online and offline stores.

- FamZoo app does not carry users’ passwords. It means that users’ personal information is secured with Mastercard and Transcard security systems.

2. MoneyLion

Founded in 2013, the famous FinTech startup in the U.S, MoneyLion, provides their users both financial advice and access to loans and other services. It comes with all the key features that top banking apps like Famzoo offer, but also comes with a credit builder loan, which is specifically designed to improve credit ratings.

Speaking of the features, which make it stand out and ranked in top banking apps is it uses superior analytics and machine learning-based technology to gain a 360 degrees view of its users’ finances and enabling personalized advice. It encompasses a built-in system of rewards, points, and incentives. In short, it encourages good financial behavior and better financial outcomes.

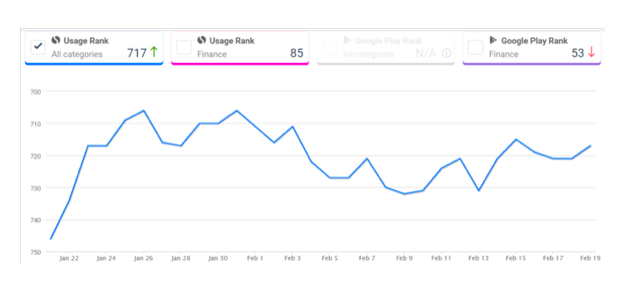

According to SimilarWeb’s report, the MoneyLion app is currently ranked #53 in Google Play Store. This banking app has over 5 million active users.

- Fast loans: Along with providing tools to track spendings, savings, and manage credits, the MoneyLion app also offers lower-cost borrowing and investment services via MoneyLion Plus Subscription. You as a user can borrow loan value up to $500 at a 5.99% annual percentage rate.

- MoneyLion’s Plus Subscription Service: This feature comes with the services like investing, borrowing, and checking accounts into a single subscription-based membership. It is based on the principle of automatically withdrawing $79 from a customer’s account per month and depositing it into $50 into their investment accounts. It only charges $29 as a monthly fee.

3. Revoult

Revolut founders (Nik Storonsky and Vlad Yatsenko) eliminated the third person to pay an extra pound for money exchange. In just a few seconds, you can transfer the money into an account with a nominal fee of 0.5% each month.

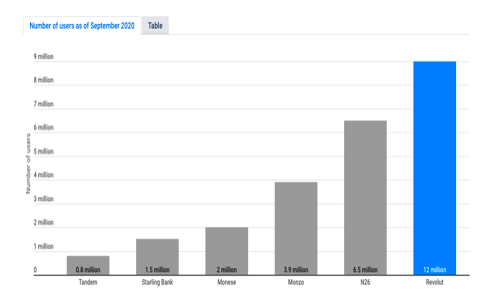

Alongside, this app provides you a money exchange feature and buying option for cryptocurrencies and gold. Moving on the footsteps of Alipay and WeChat, Revolut aims to become a world super app. Talking about the features, it facilitates you keep notifying on each transaction, rewards you on each spending, and gives you interest on your savings without a locking period. Revolut, founded in 2013, has gained attention for its fast growth, connecting half a million users worldwide in around months.

According to the report, “With a steady increase, 440,000 customers join Revolut every month on average. In December 2020, the number of customers is projected to be 16.45 million, compared to the current 12 million (August 2020).”

- Money Exchange: Exchange the money with 30+ countries with a small 0.5% fee for anything above £1,000 per month. Real-time currency rates help you to get away from fraud.

- Worldwide medical insurance: You will get access to network hospitals for any medical treatment or teeth operation during the travel. Get quick medical reimbursement through the Revolut app.

- Interest on your savings: Earn the interest on your daily savings, debit, and credit the money anytime anywhere without any day’s condition.

- Revolut Junior: Create an account of your children and teach financial budgeting tips. Parental access allows you to see the transaction of your child’s accounts. Freeze and Unfreeze feature hale you to manage your child’s transactions.

4. Monzo

For people who are looking for app-based banking to manage their money on their finger tab, Monzo is here to serve them. It was founded in 2015 by a team of six members, Tom Blomfield, Jonas Huckestein, Jason Bates, Paul Rippon, and Gary Dolman. It was the UK’s fastest crowdfunding app, they raised £1m in 96 seconds.

Featuring predefined categories to watch your expenses in which category it lies. Similar to Revolut providing you all the features without any hidden condition, the Monzo press release and weekly monthly newsletter provide you complete transparency. In addition to that gives you a bank experience where you can submit, withdraw, bill payment and ask for the loan without asking any teller in person. The prepaid master card provides you free withdrawal of money from the ATM.

- Monzo Plus: This is a premium service that serves you with a metal premium metal card, can add multiple accounts, withdraw the money from the ATM up to £600 in cash abroad once a month. Alongside, you will get a regular credit check option, interest on your savings up to 1.5% AER.

- Attractive insurance plan: Paying £75 for your phone you can claim up to £2000 and £300 on phone accessories. You can insure your travel plan by just paying £75, and get £5000 on trip cancellation, £10 million on the medical bill and £750 on lost items.

- Monzo for teenagers: Monzo provides the adult bank account with parental control for spendings. Featured with contactless Mastercard, Instant notification on spending, and bill split option.

5. Mint

To reach your budget goal, spending, expenses, bills, and your income required to monitor and manage efficiently, Mint does all the things without any cost.

It accumulates your finances, expenses, and credit at one place to show you the complete report. You will get the notification on your unusual spending against the category as you set in the account.

- Smart savings with MINTSIGHTS™, Count your every penny and provide you the notification on spending either its credit card, subscription, or any unusual transaction.

- Pie Chart helps you to provide a graphical representation of your account with defined categories.

- Bill tracker feature helps you to keep notified with the due date and supports you to achieve your goal.

- Mint knows in which category expenses/Bill have to put. If you spend on burger, it will add to your restaurant’s category.

- It enables users to sign in and you will get a free credit score and credit report.

- It allows you to synchronize your credit cards, debit card, bank account with the Mint web access feature and manage all your spendings at one central location. The backup and restore option is there.

- Save money and time, by accessing all your accounts and transactions in one place. No need to go on multiple websites to waste your time. Mint provides you with a better budgeting option to help you keep your credit score better.

- Mint helps you in refinancing your loan or mortgage just by clicking on the tab. Your prefix detail will enter into the format and will keep for a better rate of interest.

- Multi-Layered security measures help you to keep your data safe and overcome any security threat.

Wrapping Up

Understanding your requirements and needs according to your budget you can choose the best option for your money management. Money management through an app system saves you time and guides you to achieve your financial goal.

Clear your dues before the due date without any penalty will be released to those who paid the charges just forget to pay the bill on time. Mental peace is one kind of asset which cannot be justified in money so go ahead with the best money management app which suits you 360 degrees.